Your situation is unique you deserve a custom solution

|

Some times automatic is good , saving automatically each month for example, having an investment that runs on a preset algorithm may not be.

Your situation is unique you deserve a custom solution

0 Comments

Depends on who you are! Low income families and seniors are the big winners. The news could have been worse for investors.

Want to know how this impacts on your future plans? Contact me for a review . A parent : The government claims the new Canada Child Benefit will pay nine of 10 families more than they receive under existing programs. The new child benefit starts in July and applies to people with kids under 18. Benefits are tax free, which means no surprises when filing your taxes.Its likely families making over $ 150,000 will see a decrease in benefits Try this calculator http://www.budget.gc.ca/2016/tool-outil/ccb-ace-en.html Both the children’s fitness and arts tax credits are headed to extinction. Eligible expenses will be cut in half for 2016 and eliminated for 2017. The fitness credit is now worth up to $150 on expenses of as much as $1,000, while the arts credit is worth up to $75 on expenses of up to $500. An increase in child disability benefits “To recognize the additional costs of caring for a child with a severe disability,” Budget 2016 will continue the Child Disability Benefit but add an additional amount of up to $2,730 for each child who is eligible for the Disability Tax Credit. The elimination of income splitting for couples with kids Income splitting for couples with children under age 18 will be eliminated. While not referenced in the Budget document this is in direct reference to the prior Conservative government’s introduction of the Family Tax Credit, which allowed couples to income split and save up to $2,000 in taxes each year. An investment in childcare The Liberals want to invest $500 million to establish a National Framework on Early Learning and Child Care, starting in 2017 ($100 million of this is earmarked for Indigenous child care and early learning on reserve). This will facilitate how provinces address childcare needs. A college or university student: The Canada Student Grant, for young people from low-income families, will grow to $3,000 a year from $2,000 for the 2016-17 academic year; students from middle class families will see the grant rise to $1,200 from $800. A student or parent helping to pay college or university: The education tax credit and textbook tax credit are being eliminated as of Jan. 1, 2017. The education credit is worth 15 per cent of $400 for each month a student is enrolled in school full-time, while the textbook credit is set at 15 per cent of $65 per month. A recent graduate: No student will have to repay money borrowed under the Canada Student Loan program until he or she is earning at least $25,000 per year. Acknowledging the trouble young people are having finding well paying work? An investor: The government is cracking down on corporate class mutual funds, which allow people to switch money between funds in the same corporate structure without incurring a taxable gain. This switching will no longer be tax-free after September of this year. Good news! labour-sponsored venture capital funds have been revitalized through the return of a 15-per-cent federal tax credit on purchases of these investments. These funds provide a way for small companies to get financing, but they have produced weak results for investors in many cases. A low-income single senior: Payments under the Guaranteed Income Supplement top-up benefit will rise by as much as $947 per year. This measure will affect 900,000 single seniors, a group that is at particular risk of living in poverty. Someone who is looking ahead to retirement: The age of eligibility of for Old Age Security will remain at 65 and not gradually increase to 67 by 2029. Part of a senior couple that is living apart: If the couple is living apart for reasons beyond its control, say because one partner requires long-term care, then additional GIS benefits may be available, depending on income. A teacher: A new tax credit will, starting this year, help cover out-of-pocket costs for school supplies at a rate of 15 per cent on expenses of up to $1,000. Early childhood educators are also covered. Average working person: A reduction in the middle-income tax bracket As previously announced, Budget 2016 confirmed that the middle class income tax bracket would be cut from 22% to 20.5%, starting this year. That means if your taxable income is between $45,282 and $90,563, you’ll pay less tax. A single Canadian in this tax bracket will see an average tax reduction of $330 every year, while couples will see an average tax reduction of $540 per year. According to Budget 2016, nearly nine million Canadians will benefit from this tax cut, which took effect Jan. 1, 2016. The Liberals also made good on their promise to introduce a new 33% tax bracket for people who earn more than $200,000 each year.

Kathy Waite Regina, Saskatchewan, Fee only financial planning, how to retire, when can I retire, investment second opinions, retirement income specialist

Some of the most common questions we get asked

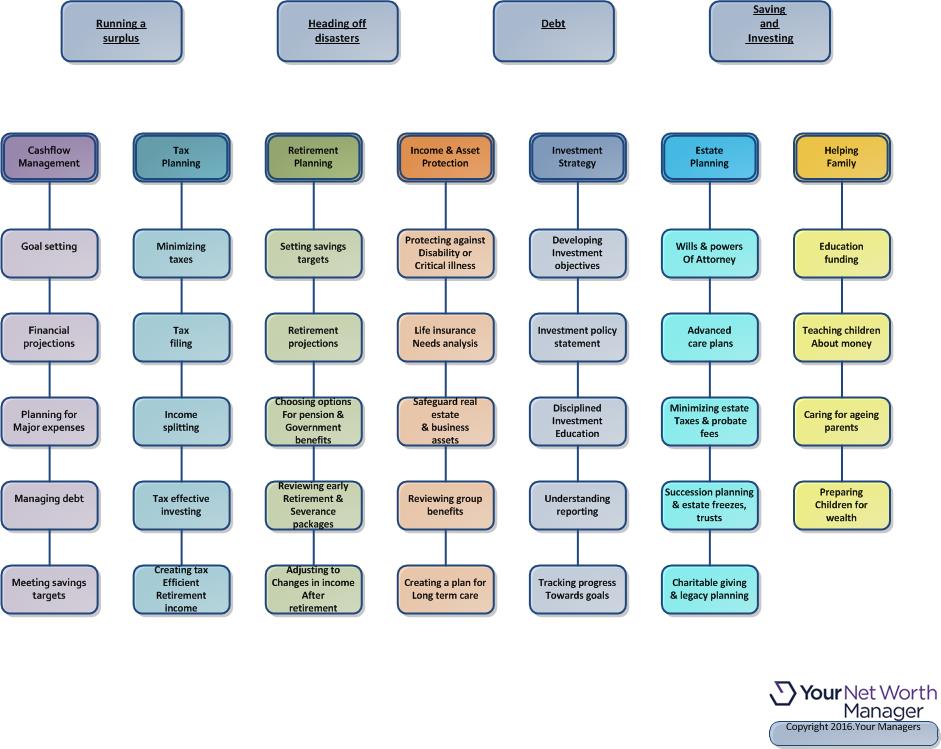

There are so many aspects to financial planning people often struggle to know where to start which leads to never starting! We use four broad categories: running a surplus, heading off disasters , making debt work for you (not against) and saving and investing. This is based on Maslows Hierarchy of Needs. If we dont get the basics in place and rush off to invest , disasters happen and blow up our investment plans and we are back to square one. Net Worth Management is the art of making the most of what you have. We start with the end in mind. Lets be clear what we are trying to achieve, assess progress so far, all the stuff you have gathered in your lifetime ( good and bad ) learn what options we have, find ways to move forward and get results for you.

You know the hard part? Its getting started , stopping the procrastination! Don't know what you want? Where you want to be in the future? I bet you know where you DO NOT want to be though! I believe in plans before products but there is a saying that nothing in life is certain except death and taxes. We don't like thinking about either very much so we have teamed up with Lorie Giddings to help clients with tax preparation for families and small businesses at a super competitive rate , a friendly smile and extreme efficiency .

We are building on the family office concept which means you go to a Net Worth Manager , financial planner, for an unbiased check up and then we bring in specialists if you need them . This is the opposite to most of financial services who start with what can we sell you today? We work together as a team for your best interests saving you time, money and stress not having to deal with sales people or trudge round looking for help. We now have Your Investment Manager, Your Tax Manager, Your Insurance Manager and are working on banking and mortgage support for our families |

Kathy Waite

|

RSS Feed

RSS Feed