|

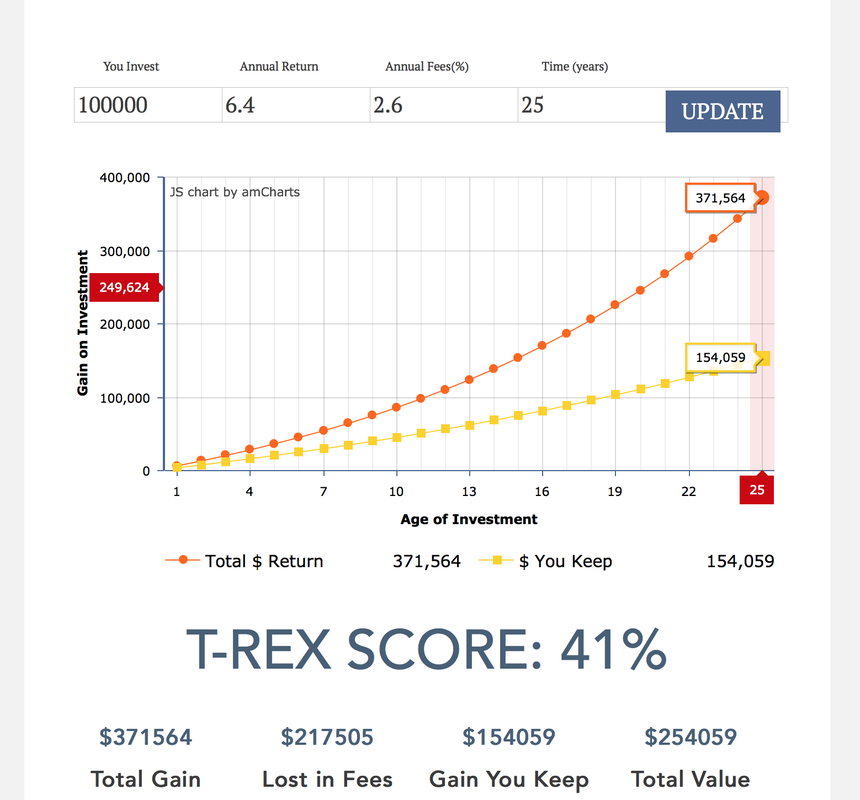

Kathy Waite Saskatchewan asks Do you know your T-REX score? Most folk use mutual funds which cost 1/3 of your money every 13 years and generally under perform the market by 2%. No wonder its so hard to save for retirement! If you want me to figure this out for you get in touch for a complimentary portfolio review.

0 Comments

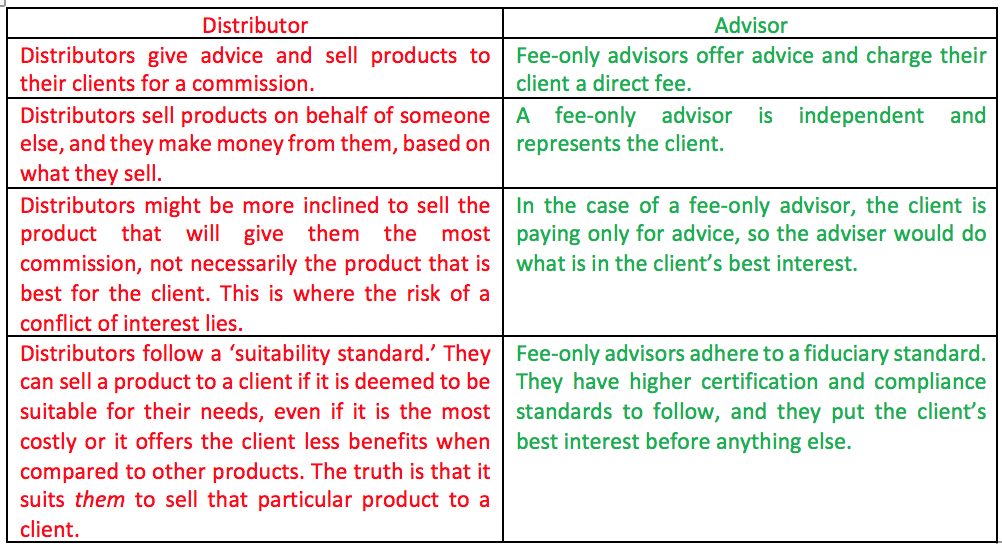

There are many times in our lives when we consult experts; we go to the doctor when we’re sick, we hire a lawyer when we need legal advice, and we hire an accountant when we need our books putting in order. Let’s first look at a trip to the doctor’s office. We have a health problem, so we confide in the doctor about how we feel and the symptoms we’re experiencing. The doctor would then ask questions, examine you, and come up with a diagnosis of what’s causing your health problem. They would then prescribe a medicine, you pay the doctor a fee for their advice, then you go to buy the medicine from a pharmacy. But what if you went to see a second doctor, and instead of charging a fee, the doctor asked you to buy a particular medicine from a certain pharmacy? What if the doctor got a cut of the money you paid for the medicine? Which doctor would you rather visit? The first doctor, right? This is a great example of straightforward advice with no conflict of interest versus a conflict of interest, and an illustration of an advisor (the first doctor) versus a distributor (the second doctor). They are not the same. So what are the main differences between a distributor and an advisor? Kathy Waite, Saskatchewan Registered Retirement Consultant explains. So the way they are paid is not the only difference between a distributor and a fee-only advisor.

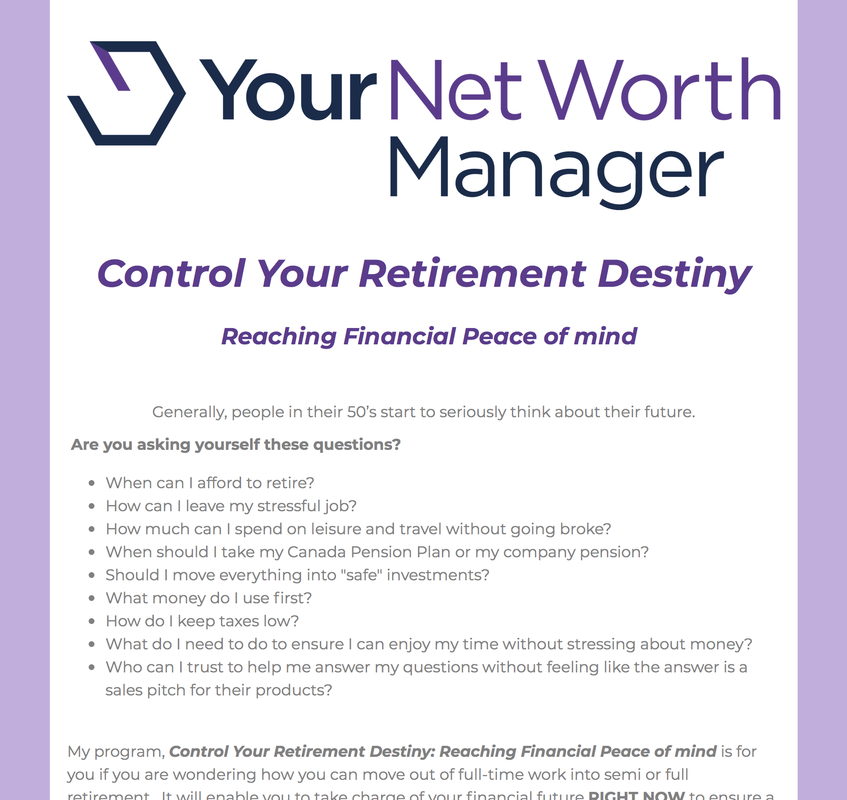

Many people don’t understand what the differences are, and they are often taken for a ride by an adviser who sells them a product based on the fact that it’s going to earn them more commission. Regulators need to protect investors to stop them being parted from their hard-earned cash that was supposed to give them a more secure future. Who would you rather have working for you, and taking care of your cash and your financial future? My number 1 tip If you want to retire earlier, and have more money to enjoy your retirement, is to use an advisor not a distributor. Call me for a free 30-minute consultation to get the best no-nonsense advice that will help you achieve financial freedom. The most recent Canadian census revealed just how much has changed in the way people live their lives. From a considerable move away from what is considered to be the ‘family unit’ to an increasingly ageing population, Canadians now face unprecedented challenges. One of the biggest changes is in how many people are now living alone as they approach retirement or when they are retired. Throughout my 30 years in the financial services industry, I have worked with 7000 families, and I now see more and more people who have either never married, or who have been divorced later in life. Whether for better or for worse, the life you expected to live is now not your reality. Most financial services are based on selling you something, so if your assets are half of what they were when you were in a couple, or half of what a couple might have if you’ve never married, you might not readily be offered the exact help you need. The financial challenges faced by single people People are living longer and they often live alone long after their partner has passed away. As well as this, people are getting divorced later in life, while others choose to remain single throughout their lives; all of these situations bring financial challenges. Here are some of the financial challenges and issues that single people have to face:

How I can help? Money is such a personal thing. We might vent to friends about it in general terms but we rarely talk specifics, so how do we know if our money situation is okay and we’re on track to achieve our financial goals? Many people feel that they want to keep their finances confidential, and feel that they don’t want to go to their local bank for advice, especially if they live in a small town, as everyone knows each other. I can offer a confidential ear, and sound advice. I understand the unique financial challenges that single people face, and I know that:

Let me guide you to a more certain future Single people can be more vulnerable to financial disaster, as they only have one income to rely on. They can get talked into bad decisions because they don’t have anyone to bounce ideas off. But now you do. The way I approach financial services is different. With fee for service, you only pay for the help you need, I do not sell products. In return, you get my honest opinion on your financial situation and outlook, and whether it’s good or bad news, we can work together to figure out a plan to get you back on track. I get called many things; from financial detective and money coach to a financial quarterback, but I prefer to think of myself as the co-pilot to your future. It can be brighter than you think. Contact me to get yourself back on track to a healthy financial future on 306 535 2255 or at [email protected] Get to know each other phone at no fee.

Click to set custom HTML

Read Ben Carlsons take on the recent market wobbles. As usual by the time I wrote this everything had started to right its self anyway. Click on the pic above to read the full article.

Regardless of whether this turns into a full-fledged meltdown or just another flash crash correction, it’s not too late right now to get your portfolio in order. It’s not too late to rebalance if you’ve let your stocks get out of whack from your target asset allocation It’s not too late to reassess your overall asset allocation to figure out the types of losses you can survive without panicking. It’s not too late to know what you own and why you own it. It’s not too late to remind yourself that risk in the stock market doesn’t care about your needs and desires. It’s not too late to remind yourself that markets are hard. It’s not too late to ensure you have enough cash reserves to make it through the next downturn, be it economic or market-based. It’s not too late review your portfolio to ensure it’s aligned with your goals, time horizon, and risk profile. It’s not too late get out of some positions that you had no business owning in the first place Looking forward to 2018? Worried? Excited?

Call me to find out how to make the most of what you have. Kathy Waite Fee only financial planner Regina Saskatchewan and across Canada Hats off and hurrah to Mark and the other trades guys for all their hard work. Follow on FaceBook to find out more https://www.facebook.com/safehomesforsinglemothersmjinc/

Do you worry about your investments? If so read this. I have written in the past about living with uncertainty. Right now there isnt much feel good factor with constant rumblings about housing market collapse, interest rate rises, government overspending yet in reality economies are doing well. Check out "Risk perception vs Risk profile" by Ben Carlson (CFA) his take on this. A blog that is worth following.

In short its down to our risk perception which is something all investors need to understand because it affects us ALL. Your risk profile is different than your risk perception. Your risk profile is a combination of your appetite for risk, your need to take risk, and your ability to take risk. But your perception of risk is very emotional and changes with time, experience, and circumstance and what you hear in the news. Understanding yourself is the most IMPORTANT part of the investment process. If you don’t understand yourself — your reactions, your personality traits, your biases, your limitations — it doesn’t matter which type of investor you’re supposed to be. It matters which type of investor you are. Some investors are constantly plagued by the fear of missing out on huge gains. Others will be haunted by the fear of being fully invested when markets take a dive. The ideal is to BALANCE out your future goals with your desire to sleep soundly at night This is why true risk management is about creating behaviorally aware portfolios, not fancy mathematical risk measurement techniques. The biggest risk for investors is never a market-moving geopolitical event. The biggest risk for investors is themselves.

Press release attached above . Congratulations Benjamin Waite and thank you for looking after my clients so well. The only flat fee Portfolio Manager in Saskatchewan.

McRaven says nothing is more important than experience. The reason he is so comfortable with his decisions is he knows he has the experience to understand how missions unfold. I can relate to this. So many people procrastinate about their money because it seems overwhelming. He says to those he briefs it may seem a complicated operation BUT he understands the problems, has the data to deal with the problems, a plan A and a Plan B, based on experience not just KNOWLEDGE he would take someone with experience OVER knowledge any day. I have 25 years plus experience so don't worry ! There is nothing you can tell me that can shock me.

Top 50 and one of the 4 finalists for 2017 Young Gun and also for ETF Champion . Benjamin Waite has worked so hard the last seven years since finding his passion and achieved designations most don’t until much older. In September he became Chartered Investment Manager ( CIM ) which means in June he achieves his goal of being a fiduciary discretionary portfolio manager. Most investment adviors in Canada work to a suitability standard , he will be one of the few who like Doctors, Lawyers and Engineers work to a fiduciary, put your client first, rule. Its not just Mom saying he is briliiant Benjamin has been congratulated by his dealer for being innovative . Benjamin runs his own practice, he doesn’t represent a large company so some industry recognition means a lot . Watch the video below to find out why you need a CIM to look after you NOT a mutual fund salesperson. Stop getting your financial education from salespeople and see a professional! The Power of Index Funds:Canada's Best-Kept Investment Secret Ted Cadsby, CIBC's vice-president responsible for mutual funds has written an excellent introductory book on indexing for Canadian investors. The Power of Index Funds: Canada's Best-Kept Investment Secret starts off by explaining what index funds are and how they work. Cadsby then explains why they're better than actively managed funds. He systematically refutes every conceivable objection that a skeptic might have. Finally Cadsby goes through the process of building portfolios and selecting specific funds for a variety of investor profiles. Index Funds is written in the same conversational style that was popularised by David Chilton in The Wealthy Barber. While some may object to this style, in my opinion it works quite well. This is a book without the jargon and endless references to obscure academic studies that one finds in most books on investing . While the book's primary appeal will be to beginning investors, Cadsby's arguments will ring true with more advanced readers who perhaps have seen some of them before in magazine articles or newspaper columns . The case for indexing is actually even more compelling than what's presented in Index Funds. That's because Cadsby uses index returns minus an MER of 0.90% as his benchmark. (CIBC's index funds charge a 0.90% MER.) But in reality it's possible for individual investors to run index portfolios for much less using competitors' index funds. For instance Altamira and Royal charge 0.50% for most of their index funds. And one can also use Index Participation Units like the new S&P/TSE 60 iUnits or the US S&P 500 SPDRs which charge less than 0.20%. Even CIBC rebates their MERs down to 0.30% for accounts that hold at least $150,000 in their index funds. In discussing how difficult it is to distinguish skilled fund managers from lucky ones, Cadsby uses the oft-cited example of 1,000 people flipping coins. After 10 tosses it's likely that at least one person will have flipped 10 heads or 10 tails in a row. But this is the result of luck, not skill. Cadsby then uses this logic to contend that it's possible for 10% of all mutual funds to beat the average fund's returns for three consecutive years due only to chance. Then he adds the coup de grace: "Given a sample size of 1,000 [ fund managers], there is some consensus that it would take around 25 years to be able to conclude that a manager is likely to be talented, rather than just lucky. Even then we're talking about a higher probability -- not a certainty." Who needs those odds? Yet despite this analysis Cadsby argues that indexing doesn't work for certain asset classes like small caps, and in Pacific Rim and "emerging market" countries because the markets on which they trade are less efficient than the large cap markets in North America and Europe. The inefficiency may be true, but it's not the only criterion. Trading costs (brokerage fees, bid/ask spreads, securities taxes and the like) are also much higher in these markets. Other indexing proponents like Malkiel and Swedroe argue that any edge an active manager may have in a less efficient market is more than offset by those higher costs. Cadsby on the other hand concludes that it's better to use actively managed funds in these classes. Kathy email : [email protected] www.kathyinthemedia.ca

What is Net Worth Management ? Video http://bit.ly/2mZdoqP Small business owners work hard to grow their businesses, keep customers happy but forget to plan for their own future until suddenly a problem arises or they want to retire. Dont be that person! Start thinking ahead of how to make the most of what you have. business owners often work so hard they focus on NOW. What is all the hard work for? Will you want to slow down at some point and enjoy the outcome of your efforts? Most owners who get in touch do so because they have a problem. Sometimes its too late to fix it. Don't be like that , take time to look ahead and put some plans in place that will make the most of what you have and any change easier eventually Buffet is very critical of high investment fees and how they drag on returns, they are a rip off, use low cost funds, track the market. A hedge fund manager bet him he was wrong over 10 years. On average the hedge fund has done 22% and the market 60% . Its looking like Warren will win. The bet money has been invested all along so a charity will benefit from a windfall of 1.9 million and the truth is proven .

The billionaire investor, who is revered for his stockpicking, has already stated that he has advised his wife to invest in an S&P 500 tracker like Vanguard’s 500 Index fund if she outlives him. “I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions, or individuals—who employ high-fee managers,” he wrote in his annual letter from three years ago. Buffett has promised to return to the subject in his next shareholder letter, which comes out on 25 February, Bloomberg reports. https://www.fundstrategy.co.uk/warren-buffett-unleash-active-managers-next-shareholder-letter/ Do you want to be financially free? Do you want your money to work for you or your broker?

There are common steps we all need to take , Warren Buffet says his secret to success are being born in America, good genes and compounding of money. Its not what you earn its what you do with it consistently that matters. Be an owner not a consumer , dont just own an Apple phone , own Apple stock. Become an insider, the system is set up for shareholders to win not the investment clients. Know your investment expenses. Your MER is not the only one , there can be 17 others hidden. The average is 3%. Takes 60 years to double your money. If you want to win a race do you want a 100 pound or a 300 pound jockey? that what huge fees do , slow you down. The big lie is you have to be rich to invest , the second we can beat the market , the third lie is fees don't matter. Learn to invest and stay invested for the long run . Also on my FaceBook page https://www.facebook.com/yournetworthmanager/

Kathy Waite Saskatchewan . Fee only financial planner. Retirement income specialist. Kathy Waite Fee for service financial planning. I am offering a free portfolio review value $750.00 to help you answer the question above.

You trust your bank. They care for you, right? They do what’s best for you? I’m afraid they don’t. The banks do not put you, their customers, first. Their main duty is to their shareholders. Recent scandals about hidden fees and blatant misinformation given to customers about their financial products has demonstrated one thing; you can’t trust them.

They were fully aware of how they were operating and didn’t bother to do anything to address the problems until they were exposed for it. It’s time to stop being the customers of the big banks and investment companies and to become the shareholders that they are looking out for. I will show you how. The scandal of overcharging Canadian banking customers have been systematically overcharged by the banks for years. Back in 2014, it emerged that Toronto Dominion (TD) bank had been directly and indirectly overcharging customers for financial products. They claimed that ‘internal errors’ had led to a situation where they failed to inform clients when they qualified for lower fees on their investment products. This resulted in some 10,000 customers being overcharged over a period of 14 years. If a client gets recommended to a fund, they can expect to pay higher fees initially if they have a small investment. If they add to their assets over time, by selling or inheriting a house or a business for example, they should qualify for a product with lower fees due to their larger investment amount. What was TD’s reason for overcharging? It was not any more work for them. When they finally admitted it, they didn’t do so out of altruism, they did it because they knew they were guilty. It took them 2 years to report it to the OSC in the first place. So, they didn’t rush! The bank eventually agreed to repay more than $13.5 million to clients and $650,000 to the OSC as a settlement cost. The other ‘errors’ the banks have been brought to account for is so-called ‘double dipping’, where customers were effectively charged fees twice on their investments. Clients had originally been sold an investment product with an embedded fee (or MER), then later as their account grew, they were moved to a part of the bank that charges a fee based on a percentage of what you have in your account. This should be a good thing for clients, as technically, the more money you have in your account, the less you should pay in fees. But if the new sales rep has been a bit lazy and doesn’t reorganise the old investment, the client can end up still paying the embedded fee and a fee on the new money added. Companies are supposed to get an embedded commission or a percentage of the account, not both. The OSC found that between 2000 and 2014, TD clients had been overcharged by $1.7 million. Another bank, CIBC agreed to repay $73 million dollars to over 80,000 clients who had been charged double fees on their investments since 2002. These banks scammed millions out of clients yet they expect us to believe that these huge amounts of money were simple ‘oversights’. They expect us to believe that somehow, these big corporations with their huge IT systems and Compliance departments missed these errors for 15 years! Every product sold is checked by a branch manager and a compliance manager to check that everything is suitable. Why did nobody say anything? Simply, it suited them not to. The banks aren’t working for you Are the banks suddenly feeling ethical by voluntarily repaying overcharged fees? Of course they aren’t. If 2008 taught us anything it’s that the big banks don’t work for us. They claim to have cleaned up their act, then scandals such as these just serve to prove that they haven’t. They act as if they are untouchable and have a blatant disregard for their clients. They do what they like and assume that you are too naive and trusting to notice. They give you statements on your financial products which are long-winded and confusing. Don’t think that this is by accident. They want to keep you in the dark and they make you feel like you are stupid if you ask questions. How many more ways will Canadians be fleeced by an industry who simply does not serve the best interests of its clients? Work with a financial planner who will put you first The big banks won’t change; in fact, they do anything to resist it. If you want things to change, you need to bring it about yourself. It’s time to stop being apathetic and putting your trust in the big banks. Instead, take control and seek advice from a financial planner who truly works for you and represents your family’s best interests. I will tell you the truth. You pay me for the advice I provide, not for a product I’m trying to sell you. Whether you are rich or poor is of no significance; someone with $50k could have more complicated needs than someone with $500k and whether you’re the former or the latter, you will struggle in the present system that makes it hard for people with a small account to become wealthy and rips off the person with the big account. It’s your money, you need transparency and you need answers. I can help. Call me for a complimentary 30-minute appointment to find out more. 306 535 2255 [email protected] Kathy Waite says 100 years of academic research explains why your mutual fund isn't working consistently and why its so hard to pick the winners from the losers. Stop looking for the needle in the haystack and buy the haystack .

Watch my Youtube playlist to find out more The retirement dream for many Canadians is to be able to live comfortably; to pay off the house, be able to travel and work only if they want to, not out of necessity. But the retirement reality is often very different. Many people haven’t saved enough to support themselves comfortably in retirement. We are all living longer, and facing the real possibility of outliving our retirement savings.

Planning for retirement is not what it was. Gone are the ‘job for life’ company pensions, confidence in assistance from the government and knowing that come your 65th year, you can retire. Worryingly, around 50% of Canadians are concerned that they will not have enough income to be able to live comfortably in their retirement. 3 in 5 people have no idea about how much money they will need to live on and 47% of those aged 55-64 have no company pension provision. This is a ticking time bomb. If you have invested for retirement, the chances are you will find that your investments aren’t yielding the returns required to live comfortably. Why? you may ask. Because your gains have probably been considerably reduced by hidden fees and costs. Most Canadians are generally unaware of what fees and costs they are paying and are often shocked and upset when they discover exactly how much their retirement nest egg has been reduced. In 2016 the Canadian Securities Administrators (CSA) introduced the CRM2 regulation to force mutual fund companies, providers and financial dealers into showing investors exactly what they are paying in fees each year. This will help to you have a greater understanding of how your investments are working for you, and ultimately will allow you to take control of your financial future. What fees am I paying? The fees you have been paying are usually hidden in the small print in mutual fund fact documents and prospectuses, and hidden behind financial jargon like ‘embedded trailer fees.’ The ‘trailer fees,’ put simply, are commissions paid to sales representatives by mutual fund managers in return for recommending their fund to you. These funds usually have some of the highest fees in the world, so this practise clearly does not represent the best interests of the investor. The sales representatives will often say they are independent, but their licences are usually sponsored by an insurance company, bank or dealer and they are incentivised to sell their products, so it’s not strictly true. The problem is that most people will trust those with ‘financial planning’ designations so they don’t tend to ask questions. What does CRM2 mean for you? Every year, your investment dealer or advisor must send you a report detailing the exact fees you will be paying and how much compensation you’re paying them. Whether you pay $100 or $10,000, you will know the exact amount. Also, you will receive an annual report that gives a clear picture of how your investments are working for you. The report will detail your personal portfolio performance for the previous year and since opening your account. Before CRM2, firms were only required to provide you with information on the rate of return you could expect overall. This annual information will help you make sure that your investments are aligned with your best interests and long-term financial and personal goals. Even though the regulation was introduced in the summer of 2016 , you may not be able to get the information right away, as most firms will most likely produce the reports on a calendar year basis. Most investors should expect to be able to access their reports from early 2017. What does CRM2 mean for the financial industry? It may seem like CRM2 puts pressure on financial dealers and advisors to prove that they are worth the fees clients are paying for their services, but aside from the requirement for enhanced reports, we should not lose sight of the fact that financial professionals should be helping clients understand their investments right from the start. Advisors need to align their services and advice with their client’s goals. These goals are increasingly geared towards meeting personal non-financial life objectives. It’s all about forming strong relationships with clients to help them achieve their financial dreams. There needs to be a clear line drawn between offering a client advice that is going to work in their best interests, and merely selling them a financial product. Most financial plans are a sales pitch disguised as advice. Someone knows what they want to sell you, and the financial plan will have the desired outcome; for them, not you! If you are fed up about being kept in the dark or of being misinformed, contact me, I can help you! The philosophy here at Your Net Worth Manager, is ‘plans before products.’ I will work with you to set goals for your financial future, help you to figure out a solution to your problems, and above all, tell you the truth. That is what makes me different. There’s no conflict of interest or hidden fees, just the right advice for you, when you need it. We have less control than we would like over what happens in the world. How do we live with that?11/17/2016 Responding to families concerns about the outcome of the US election, our seemingly wobbly Canadian economy , has made me realise 99% of what I do is help people make important decisions in the face of irreducible uncertainty. Despite all the pretty forecasts and projections, no one has any idea what the future holds. This week’s earth quakes in New Zealand remind me when we left England in 2004 those towns hit were ones we seriously considered living in, but we came to Saskatchewan instead, luckily! The operative word there being luck. No one thought Brexit would happen , no one thought Trump would get in. Then, surprise! It did and he did. Brexit, elections, earth quakes , what will carbon tax mean for our province, when will ( if ever ) the oil industry pick up and families feel secure again, reminders that we have less control than we would like over what happens in the world. Uncertainty scares the bravest of us. We don’t like not knowing what the future holds. In fact, we pay people to tell us stories about the future so we can pretend we know what will happen. Weather, economic, pollsters, financial forecasts. TV channels like CNBC exist to fulfill this wish on a minute-by-minute basis. But the evidence is absolutely clear that trying to time the market based on what someone says on TV is a total waste of time. So why do so many people do it every day? Because we would rather be certain and wrong about the future than admitting we have no idea and deal with those feelings. But here is the reality: Uncertainty is reality. Everything else is just a made-up story. So, among the many other questions these events have raised for me is : How do we learn to live with it? Separate the story from the reality. In this case, Trump is president-elect.That’s the reality. Anything that goes beyond that is a story. Will he build a wall? Will he repeal the Affordable Care Act? Will he blow up the NAFTA agreement or approve pipelines ? What will that do to the economy and my investments . Who knows, and the more we try to predict what will happen, the greater the anxiety. Stay focused on the reality. Make a list. What can you control right now? The list won’t include big things like dealing with Russia. But you do have total control over sticking to your cash flow plan, planning your next vacation, how you treat your neighbour and not throwing your asset allocation out of the window because of something your heard on the TV . Anything that doesn’t appear on this list is out of your control so don’t stress yourself by focusing on it . Keep calm and carry on . The track record for new presidents getting things done is pretty abysmal and I am not too worried about an earthquake on the good old prairies. Meet you down in the basement if the wind picks up though! Kathy Waite Fee only financial planner, money ninja in Saskatchewan . Your Net Worth Manager , plans before products. Working for you not a huge companies hidden agenda . If you are feeling uncertain give me a call to see how I can help .

Kathy Waite fee only financial planner in Regina. Saskatchewan . Some people are doing RRSPs and they shouldn't be, are you?

Kathy Waite fee only financial planner, retirement income specialist , Saskatchewan and Canada . Money makeovers and portfolio second opinions . Myth buster , financial detective, money ninja

|

Kathy Waite

|

||||||

|

|

RSS Feed

RSS Feed