|

Kathy Waite Regina Saskatchewan fee only financial planning. retirement income. TFSA RRSP LIRA

0 Comments

My job is to simplify your complexity in an increasingly complex world with way too many choices

One of the biggest changes I’ve seen in the world over the past few decades is the continual increase in complexity that we have to deal with—some of it due to one thing: the exponential growth of technology. If you look back to the mid-20th century, life was much simpler. People often worked for one organization their entire lifetime, giving them a sense of security that simplified their lives. And they could likely learn the skills needed to succeed in their position in six months or maybe a year, affording them a high degree of predictability. The whole of society had a sense of predictability to it. Predictability vs. life after the microchip. Enter the microchip in the mid-1960s. With it came increasing complexity in every area of life bringing us massive amounts of information. The majority of people, though, don’t like change; it’s actually a negative experience for them because of all the complexity that comes with it. My thinking, though, is that change in the world is a good thing because it creates a wonderful opportunity Financial planning is as much about transition management and making the most of the opportunities change brings as the numbers. I monitor change in finance daily, I am curious as to how we can use this to enhance our lives and am very resourceful when new situations present themselves . Kathy Waite Saskatchewan Regina fee only planning retirement income specialist. Kathy Waite Regina Saskatchewan Fee only financial planning, Canada child benefit

Globe and Mail November 11th 2015 Kathy Waite, a fee-only financial planner in the Regina, Saskatchewan area, says not only are women like this easy prey for fraudsters but they are also sitting ducks for financial professionals who wish to push their own products on them, even with the best intentions. Click on the picture above to read the full article in Globe and Mail with my comments . Prevention is better than a cure . Lets get organized and educate ourselves before it comes to this ! Waite says the best advice for women who find themselves at sea with their finances after the loss of a partner is to just do nothing for a while. “I always tell them not to rush into any changes,” says Ms. Waite, who runs Your Net Worth Manager, a financial planning service with clients across Saskatchewan and, by remote, across Canada. “I encourage them to ask questions and to get any answers in writing. At the risk of sound self-serving, I would say, go look for someone who doesn’t sell things – someone who will just charge you for the advice and doesn’t have a vested interest in selling a product.” She advises women to bring a friend – not necessarily a family member – to any financial meetings. She says often professionals will decide that “mom isn’t coping” and turn their focus to the relative. Ms. Waite says it is easier for women to break finances into smaller goal-oriented chunks, such as living debt free and leaving money for children, rather than swimming against a tide of jargon Kathy Waite Regina Saskatchewan Financial Planning , retirement, investments RRSP, TFSA

Kathy Waite Fee only Financial Planning Saskatchewan Retirement income and lifestyle specialist and money ninja all round helpful person

Kathy Waite Saskatchewan Regina Fee only Financial Planner Personal Trainer for your money

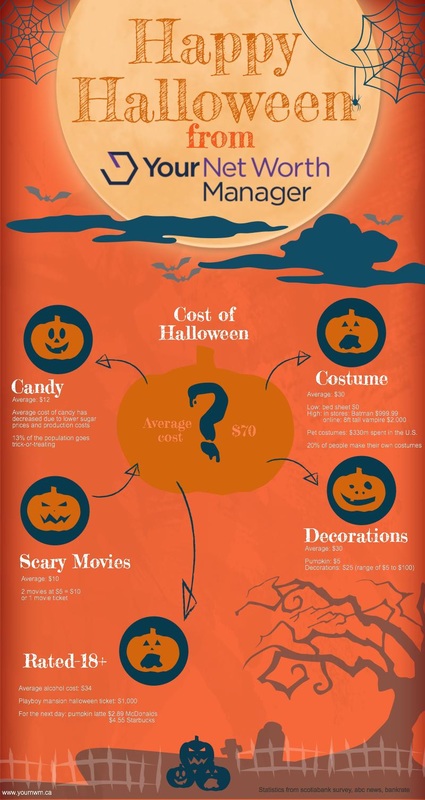

Figuring out how to make the most of your finances shouldn't be scary! Contact me for unbiased independent advice and a real plan not a sales pitch for products disguised as a plan. Kathy Waite Saskatchewan Regina

Deal with a commissioned sales person for your car or buying a TV but not your life savings for goodness sake! Plans first products last! Kathy Waite Fee Only Financial Planning Regina Saskatchewan Kathy Waite Fee Only Financial Planner Regina Saskatchewan.

The end of the $10,000 TFSA, higher taxes for the 1% less taxes for middle Canada

Liberal leader Justin Trudeau has repeatedly pledged help for Canada’s middle class. Here’s what he’s promised to do as Prime Minister of Canada as it relates to household balance sheets. Cut the annual Tax Free Savings Account (TFSA) contribution limit from $10,000 back to $5,500. Arguably one of Trudeau’s least popular campaign promises (an Angus Reid survey recently found that 67% of Canadians aren’t in favour of any political party reversing the increase), the roll back could cost savers tens of thousands of dollars over the long. High-income individuals stand to lose an estimated $53,000 over 30 years, assuming 5% equity returns and a combined federal and provincial tax rate of 50% Raise income taxes on the top 1% of earners, trim it for everyone else. a promise to cut the middle income tax bracket from 22% to 20.5% for Canadians earning between $44,700 and $89,401 a year, amounting to savings of $670 a year (or $1,340 for a two-income household). He’s also promised to create a new tax bracket of 33% for those earning $200,000 a year or more. Reduce payroll taxes. (EI) premiums are expected to fall to $1.65 per $100 under a Liberal majority government. Give a little here, take a little there, from young families. Trudeau has vowed to cancel the up to $2,000 annual benefit to couples with kids under the age of 18 leveraging the recently introduced income splitting for families option. He also said he would ditch the Universal Child Care Benefit for Canada’s wealthiest families and instead introduce the Canada Child Benefit that will give the majority of families up to $2,500 more, tax-free, every year (typically for a family of four). Home-ownership . A 10-year investment in social housing, prioritizing affordable housing and seniors’ facilities (including building more units and refurbishing existing units) as well as removing all GST for developers of new affordable rental housing projects. The Liberals also said they would loosen the existing qualification rules for the Home Buyers Plan allowing more Canadians affected by sudden and significant life changes (such as divorce) to access their RRSP savings for a down payment on a second home. Restore the traditional retirement age. The Liberals have vowed to restore the Old Age Security eligibility ages back to 65 after the Conservatives under Stephen Harper had introduced a plan to gradually raise the eligibility age to 67 for anyone born in or after 1958. Trudeau has promised however to leave pension income splitting intact for seniors as well as introduce a new seniors price index to ensure benefits keep up with rising living costs and a 10% boost to the GIS for single, low-income seniors. Grants and grace periods for students and young professionals. Trudeau made headlines when he said he would eliminate the need for graduates to repay their student loans until they are earning at least $25,000 per year. He also pledged to increase the maximum Canada Student Grant to $3,000 per year for full-time students and to $1,800 per year for part-time students while increasing the income thresholds for eligibility so that more students can access to the program. On the flip side, Trudeau said he would cancel existing textbook tax credits for all.  Lamar Odom in happier healthier times. Whatever you think of the Kardashian saga no one would wish this mess on their worst enemy. Despite divorcing word is he didn't update wills and health care directive so guess who now gets to make the decisions? My clients are used to me showing up with the medication bottle we put all this info in in the fridge door so medics and family can find it QUICK. Click on the picture to read the full article in Wealth Professional When it comes to picking winners studies show most of us overestimate the importance of skill and underestimate the role of random chance.

I believe in "evidence based investing" not the sales pitch we are so often fed to sell products. I never expect a client to believe me we review the solid academic theory behind decisions together. Kathy Waite Fee Only Financial Planner Regina Saskatchewan Ask an active manager where he stands on EMH and wait for the nervous twitch to start

What is EMH? Efficient Market Hypothesis : Together we know more than we do alone In excess of 39 million trades a day $200 billion go on each day That collective knowledge is powerful When you try to predict the market it adds anxiety and risk , you are competing against the collective knowledge of all these buyers and sellers. Markets are efficient enough trying to outperform them through stock picking or market timing is a waste of effort, time and money, as this video explains Kathy Waite Regina Saskatchewan Fee Only Financial Planning Eugene Fama not a household name but should be. Known as the Father of Modern Finance he jokes about his Italian roots preferring to be called the Godfather, controversial, admired by academics and unloved by Wall Street.

50 years ago Nobel Laureate Fama became the first big user of computers in finance applying scientific rigor to investment management. In the video clip I love the computers that run off hole punched cards. Fama believes that market prices include all known data therefore it is impossible to consistently beat the market. Frequently saying it means that the vast majority of investment professionals add no discernible value ( just go buy the market ). Watch out for the wolf of Wall Street Fama!

Its different this time ( not ) :

Click on the pic above to hear an opinion without an agenda, don't let fund companies scare you into churning your account or not using your money.

Contact me for fee only financial planning in Saskatchewan . Kathy Waite Daily I work with clients to "disaster proof" their lives. For you youngsters we make sure that life can go on as normally as possible for your family if you are no longer here and for the empty nesters that everyone knows where everything is and what to do " just in case" .

It all seems pretty theoretical but time to time I come across someone who didn't do it and the worst happened and they regret it . Read Crystals story by clicking on the picture below , she was away on a conference, her husband age 33 was home with the kids and died in his sleep . She says "My husband didn’t have life insurance, which was a bad call on our part (if you don’t have life insurance, get it now) and the burden placed on us with final expenses & moving expenses has been tremendous, which just added stress onto our already broken hearts. " Lets keep Crystal and the kids in our thoughts and make sure it doesn't end this way for any one we love Kathy Waite fee only financial planning in Regina, Saskatchewan You have a financial plan? But are you implementing it? No change no results Plans before products!

I have been a busy bee, upgrading my education with a new designation. Will be sharing with all my clients as i go .

|

Kathy Waite

|

RSS Feed

RSS Feed